Decoding the Consolidation in Telecoms: Exploring Deals Rationale & Sizing Synergies

Decoding the Consolidation in Telecoms: Exploring Deals Rationale & Sizing Synergies

The telecom industry has witnessed many shifts over the past years during which telcos constantly revisited their strategies to address different challenges. From managing CAPEX and network investments to dealing with competition from new types of players or investing in digital transformation and customer-experience-revamping programs, stagnating revenues continued to be a matter to be addressed. Most global telcos embarked on efforts to diversify services beyond core connectivity, exploring offerings such as banking, mobile financial services, advertising, or media either organically or through acquisitions. For these operators, such efforts have resulted in more than 20 percent of their revenues being generated from non-core services.

In-market consolidation moves by telcos

While these efforts had some impact on revenue levels and composition, costs attributed to network expansions, supply chain crunches, and burgeoning data consumption continued to grow. As a result, strategies followed by operators ranged from rationalizing their footprint, carving out infrastructure such as data centers, fiber, or towers, or accelerating transformation programs among other initiatives. Some operators (mostly in Europe and North America) have turned to in-market consolidation to address ramping costs and improve their value proposition.

Our analysis¹ shows that the rationale behind these deals is one of the following:

Competitive Positioning: Telcos trying to improve positioning in the market by either expanding the network footprint or by complementing their product portfolio.

Driving Scale: Telcos realizing efficiencies by offering converged services (mostly applicable to fixed/mobile or mobile/cable deals) and cross-selling to the growing customer base.

Cost Synergies: Telcos achieving cost synergies (OPEX and CAPEX) across different areas. This is in fact one of the main driving factors behind the deals.

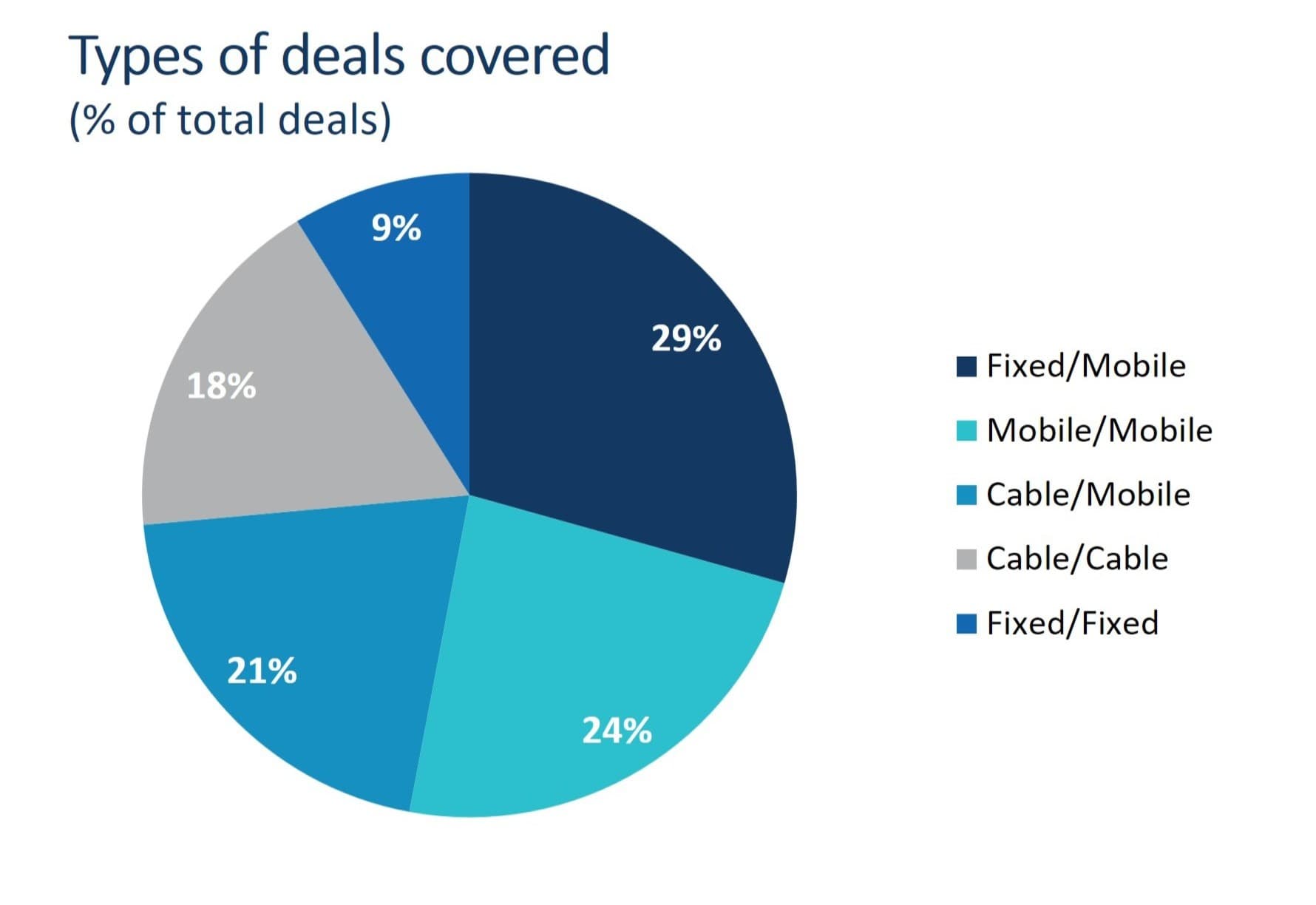

The most common type of telcos’ in-market consolidation is Fixed-Mobile (“F/M”), followed by Mobile-Mobile deals (“M/M”). These two types accounted for almost 55 percent of total in-market consolidation transactions over the past 10 years, with Germany and Spain witnessing the highest number of deals.

Deal synergies

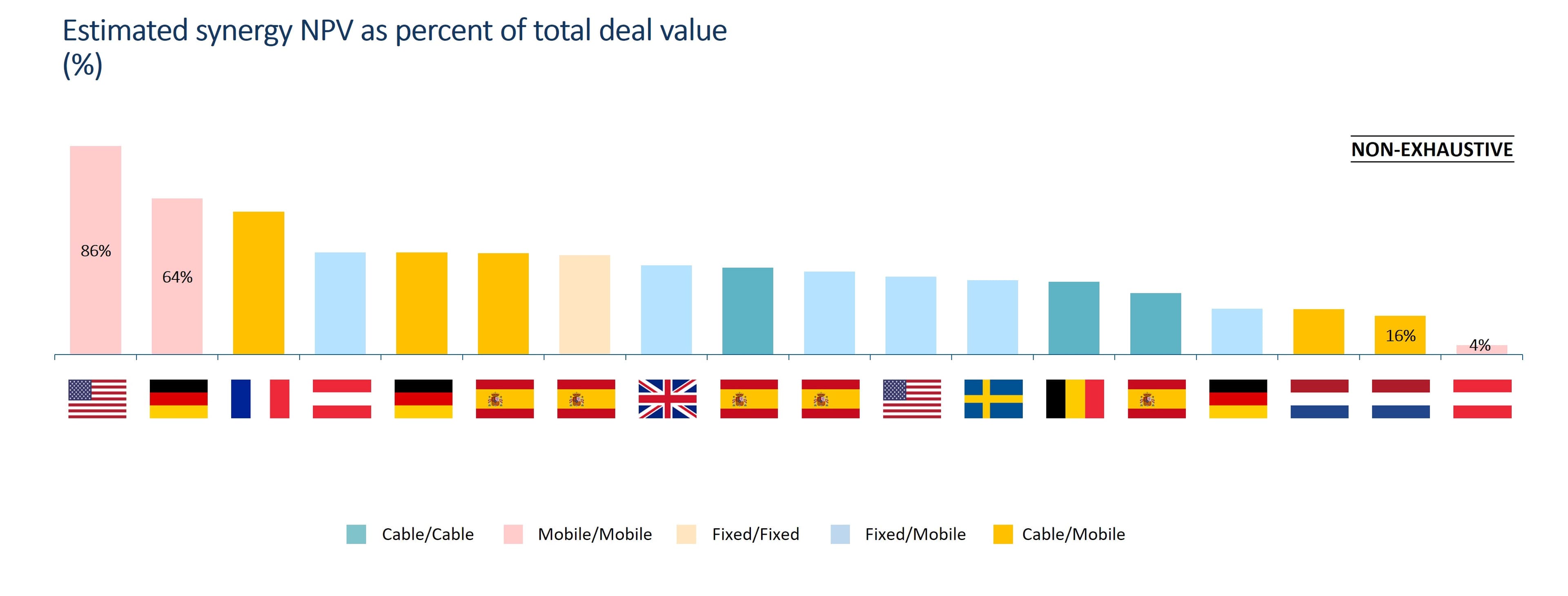

For the transactions analyzed, deal synergies accounted for nearly 30 percent of the headline EBITDA multiple and 36 percent of the total deal value². Synergies occur when the combined operations of two companies create value that is greater than the sum of their individual operations.

For M/M deals, 50 percent of the total deal value could be attributed to synergies resulting from cost savings from combining operations. This includes efficiencies like combining sales and marketing teams, reducing redundant network-related expenditures, and streamlining operations across IT teams. In fact, synergies realized across the network and IT segments accounted for 40 percent to 74 percent of the total operating synergies, with the network component having the highest contribution to OPEX and CAPEX synergies.

Integration costs

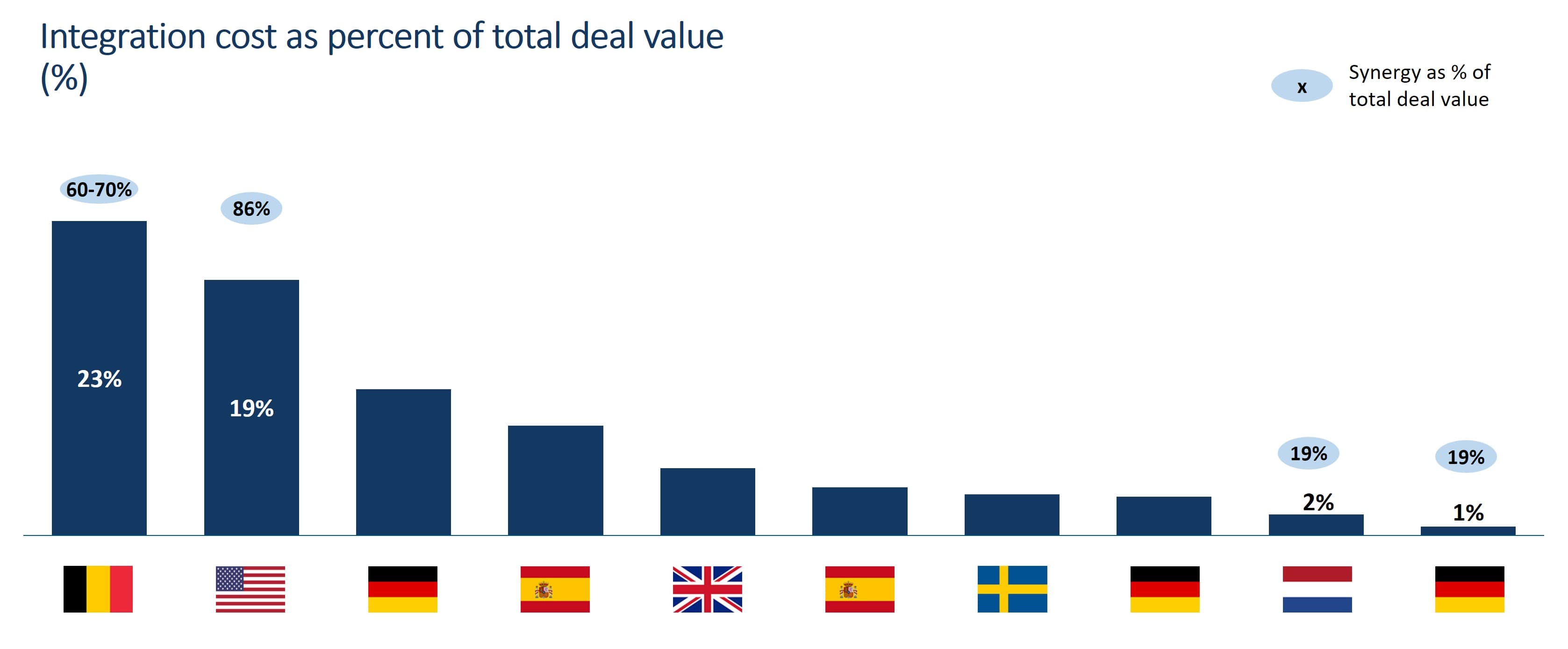

Beyond the potential benefits realized via consolidation deals, it is important to consider the integration costs, which can often outweigh the potential synergies of a merger. Integration costs are often directly related to the deal’s ambitions across several aspects including but not limited to the targets set for cost savings and revenue growth and the adjustments necessary to ensure regulatory compliance (this is especially true in heavily regulated markets like Europe).

Integration costs have been linked primarily to the size of the deal — the larger the deal the greater the costs required for making the integration a success. Our analysis confirms this hypothesis, but it also reveals a relationship between integration costs and synergy targets — the higher the estimated synergies, the greater the integration cost.

For most deals, integration costs have accounted for 1 percent to 7 percent of total deal value with a few notable exceptions. One example is Telenet (the third-largest cable operator by subscriber market share in Belgium at the time of the deal), which acquired Base (a leading mobile operator in the Belgian market). The acquisition was completed in February 2016 and resulted in the creation of a strong converged player and a better market structure. The integration costs of this deal amounted to approximately 23 percent of the total deal value. The integration costs were driven primarily by the upgrade/extension of Base’s mobile network and the improvement in fiber backhaul, accounting for close to 70 percent of the total integration cost. The total deal synergies as a percentage of deal value amounted to 60 percent-70 percent. This was driven mainly by Telenet’s MVNO to MNO conversion (~12 percent of total synergy value), the elimination of network redundancies, cross-selling opportunities, and overall improvement in network quality. The deal between Telenet and Base became one of the most successful deals in recent European consolidation history with an OpFCF increase of 45 percent three years after the merger.

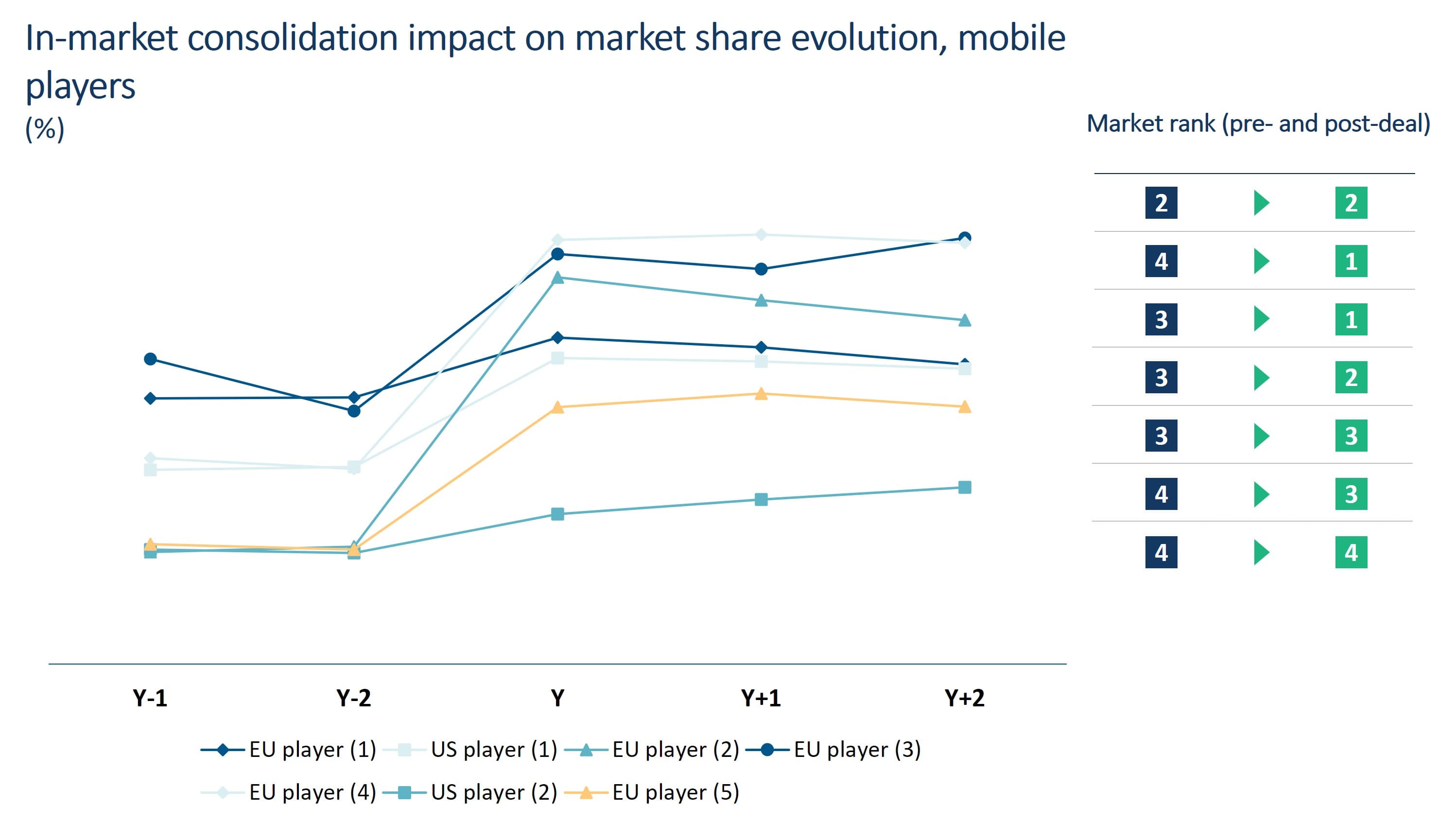

Market positioning of new entities

As previously mentioned, while cost synergies were found to be the driving factor behind some consolidation deals, the improvement in market rank for some players was found to be another strong deal rationale. Deal types involving the same type of players (where both entities are either mobile, cable or fixed operators) have resulted in an improvement in the new entity’s positioning and market share. However, other deals involving different types of players (cable/mobile, fixed/mobile) did not necessarily result in an improved market share of the combined entity but rather allowed for some efficiencies or scale by enabling a converged value proposition and cross-selling opportunities.

Regulatory remedies

However, many deals resulting in better market positioning for the new entity and realizing some of the highest synergies have faced regulatory hurdles quite frequently, especially in Europe. Regulators have imposed some remedies for such deals to go through to ensure that the market structure and competitive environment are not negatively affected. For instance, the aforementioned Telenet-BASE acquisition was conditional upon BASE selling its 50 percent stake in JIM Mobile and Mobile Vikings MVNOs.

Remedies often depend on the market maturity, the size of the player (dominant power before or after the deal) and its assets, and the potential impact on market structure. One of the most common regulatory obligations observed is national roaming (Telia’s acquisition of Tele2 Sweden was conditional upon providing national roaming to Ice Norway for six years). Other common deal conditions include offloading infrastructure or network assets such as spectrum sale (Orange/Jazztel deal in Spain, Three/Wind deal in Italy), network capacity sale (O2/E-plus deal in Germany), or fixed assets divestment (Vodafone/Ziggo deal in the Netherlands).

Cost synergies achieved by successful in-market consolidation deals have helped telcos address some of the mounting cost challenges. The regulatory remedies imposed have seen operators dispose of some assets and increase cooperation in the market by offering roaming or access to network capacity with a good market structure and healthy competitive environment as a guiding principle. Some new entities formed after the completion of the deals have seen an improvement in market positioning, enriched value proposition, improved revenues, or rationalized costs.