Telcos’ Pricing Strategies

Telcos’ Pricing Strategies

As global economies go through cycles, governments and central banks have implemented various fiscal and monetary policies to manage their economies and push certain indicators toward target levels. In some countries, these policies have been shown to elevate inflation levels in recent years, creating more price-sensitive consumers and businesses with eroding margins in many industries, including the telecommunications industry.

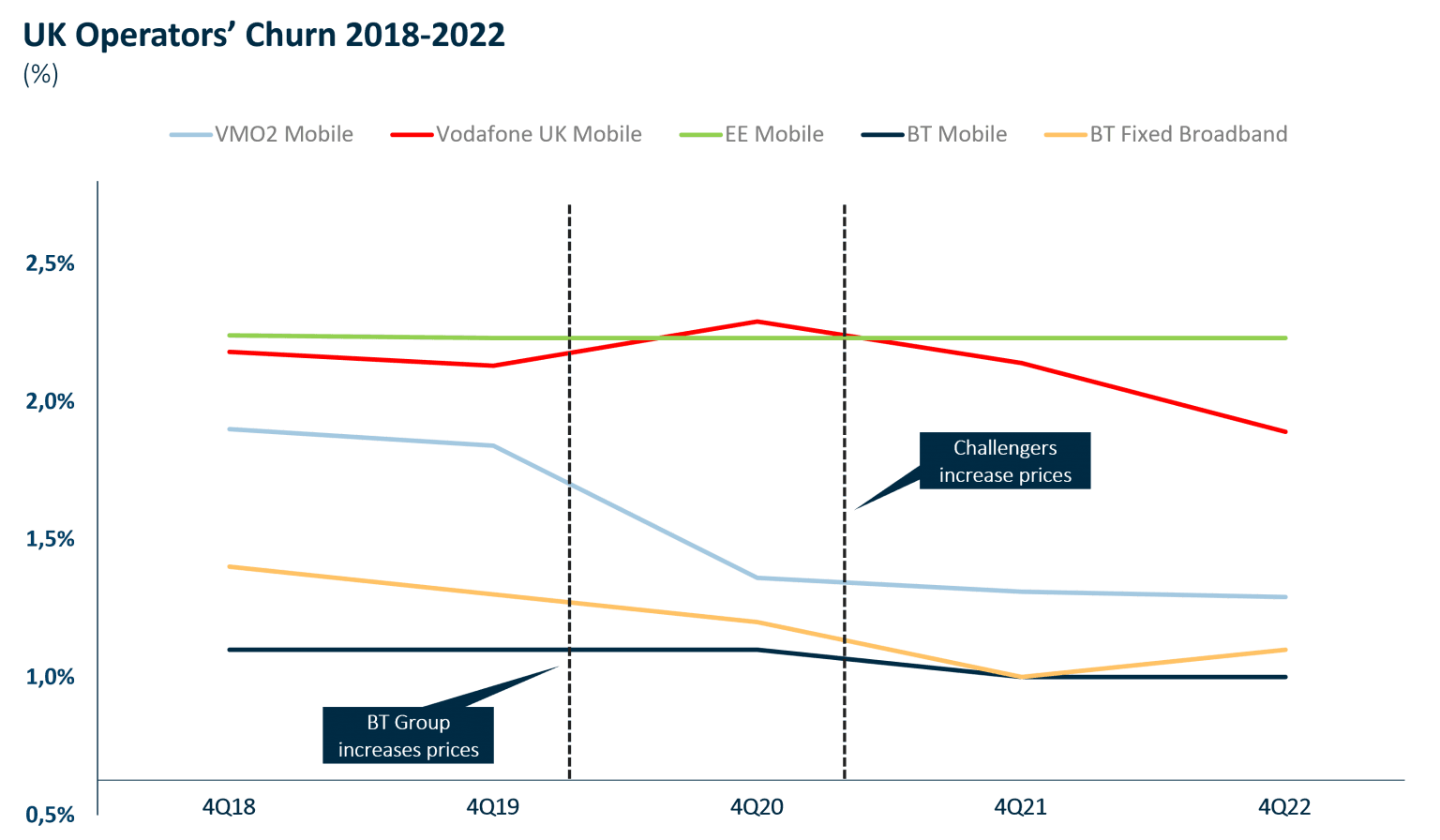

In response to increased inflation levels, some telcos have opted for price increase strategies to pass some of the cost to the subscribers. This attempt generally seems to have worked, as some of these telcos managed to stabilize revenues and manage churn.

Impact of Inflation on Telcos

Inflation has a significant impact on telcos’ cost structures, including both capital and operating expenditures, consequently affecting margins and profitability. Telcos’ cost elements have seen various exposure levels to inflation, but some key OPEX components — namely energy costs and salaries/wages — have suffered from inflationary pressure in recent years.

For example, energy costs amount to close to 2% of incumbents’ revenues in Europe, and hence, increasing energy prices (for reasons such as reducing global oil output) can have a pronounced impact on these telcos’ costs. For these European telcos, employee salaries constitute over 15% of total revenues and represent another cost element directly affected by inflation. While cost-cutting measures implemented by telecom operators (layoffs, delayed network investments, automation, network sharing, etc.) kept some cost elements under control, passing these costs to the end users through price increases was a strategy adopted by select telcos to manage profitability.

Price Increase Strategies

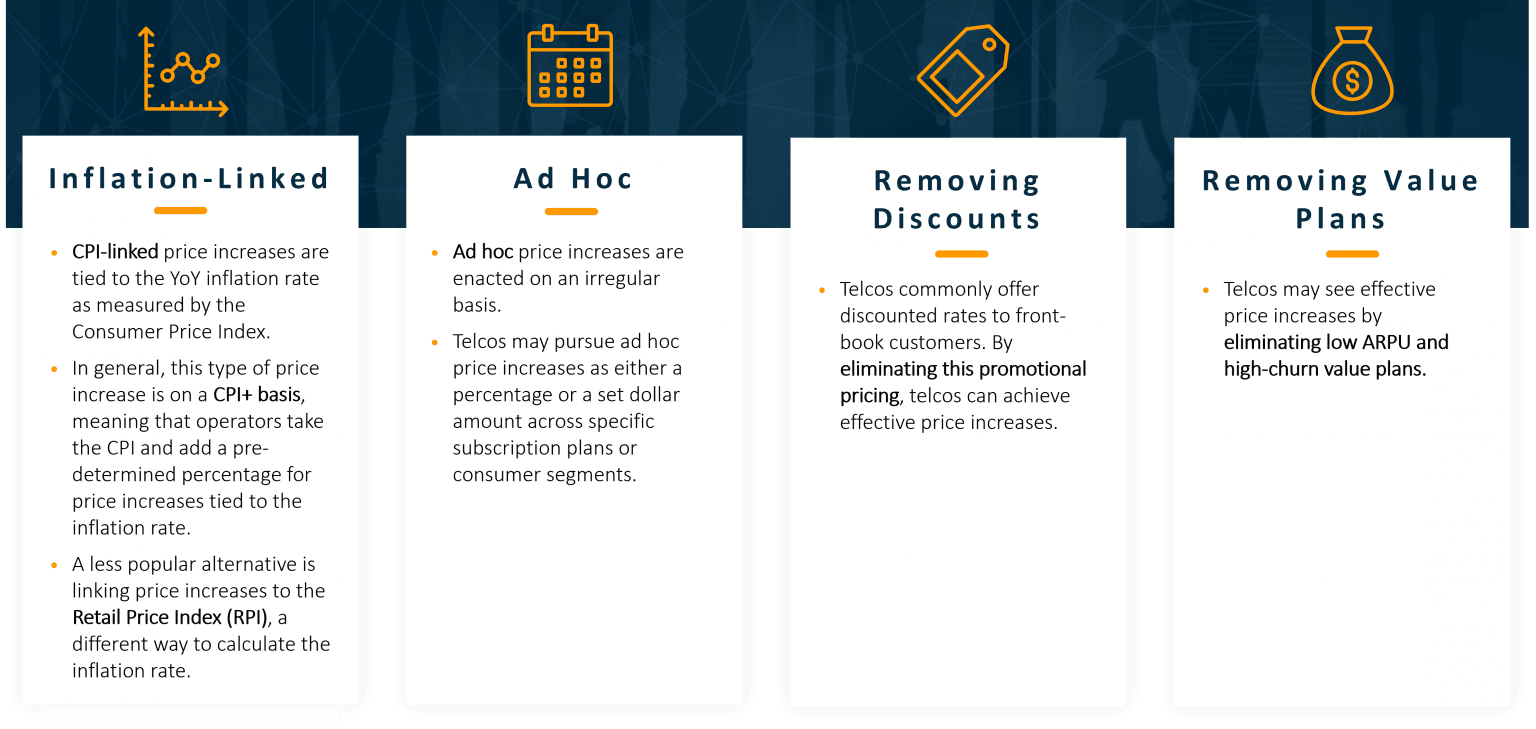

Telcos in some markets have implemented planned, inflation-linked price increases in their offers, whereas others have taken a reactive approach in which price increases are implemented on an ad hoc basis. Price increases can happen through a variety of means, ranging from introducing overt price rises for new or existing customers to removing discounts or discontinuing value plans. Incumbents tend to be the first to implement price increases, backed by a relatively solid market share and position. While challenger operators generally follow suit, disruptors in some markets (e.g., T-Mobile in the United States and Vodafone in Australia) tend to freeze or decrease their prices to attract subscribers.

Back-Book and Front-Book Price Increases

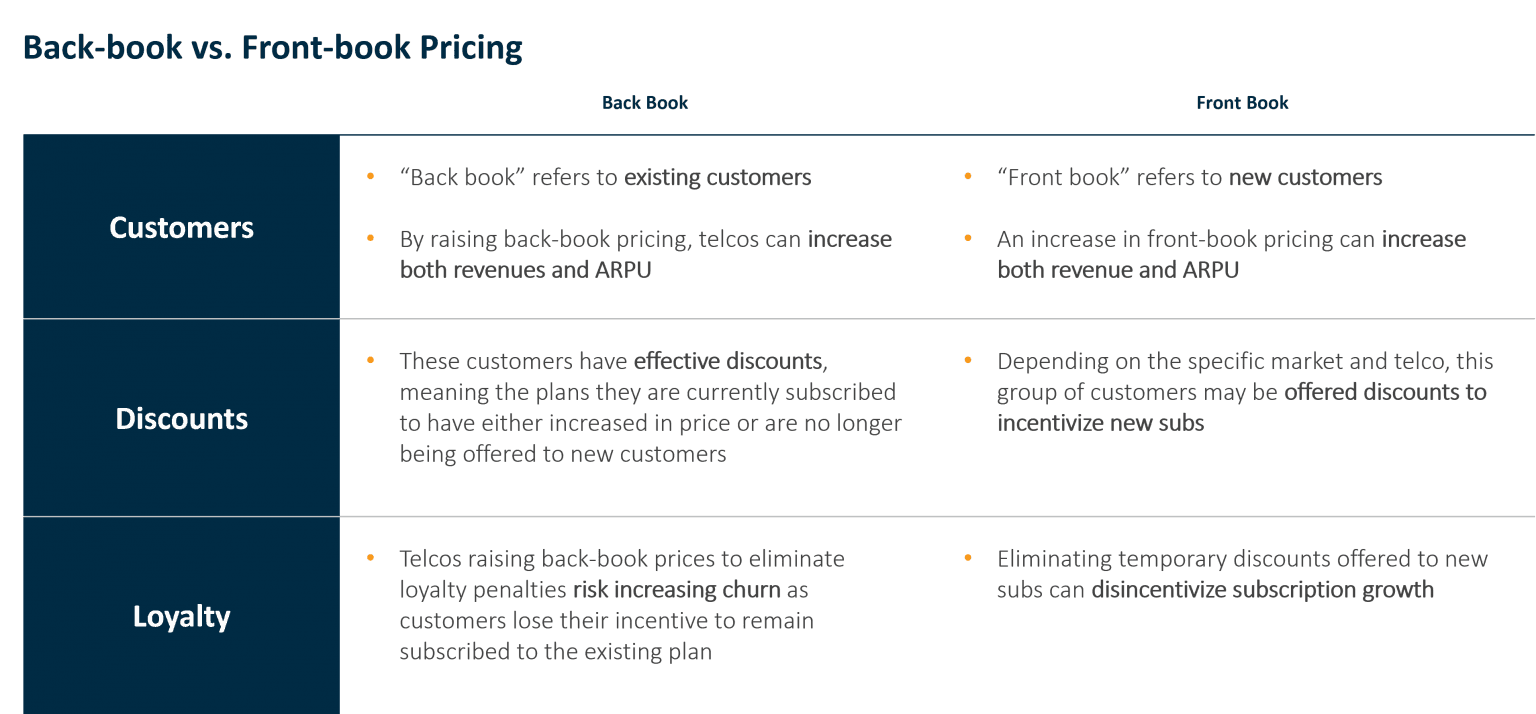

For subscribers on legacy contracts or plans (back book), telcos honor the originally agreed prices to retain the customers’ loyalty. However, a large back book can be a risk for telcos in a high-inflation environment, since the offered discounts affect revenue growth. Price increases are easier to implement for new (front book) customers.

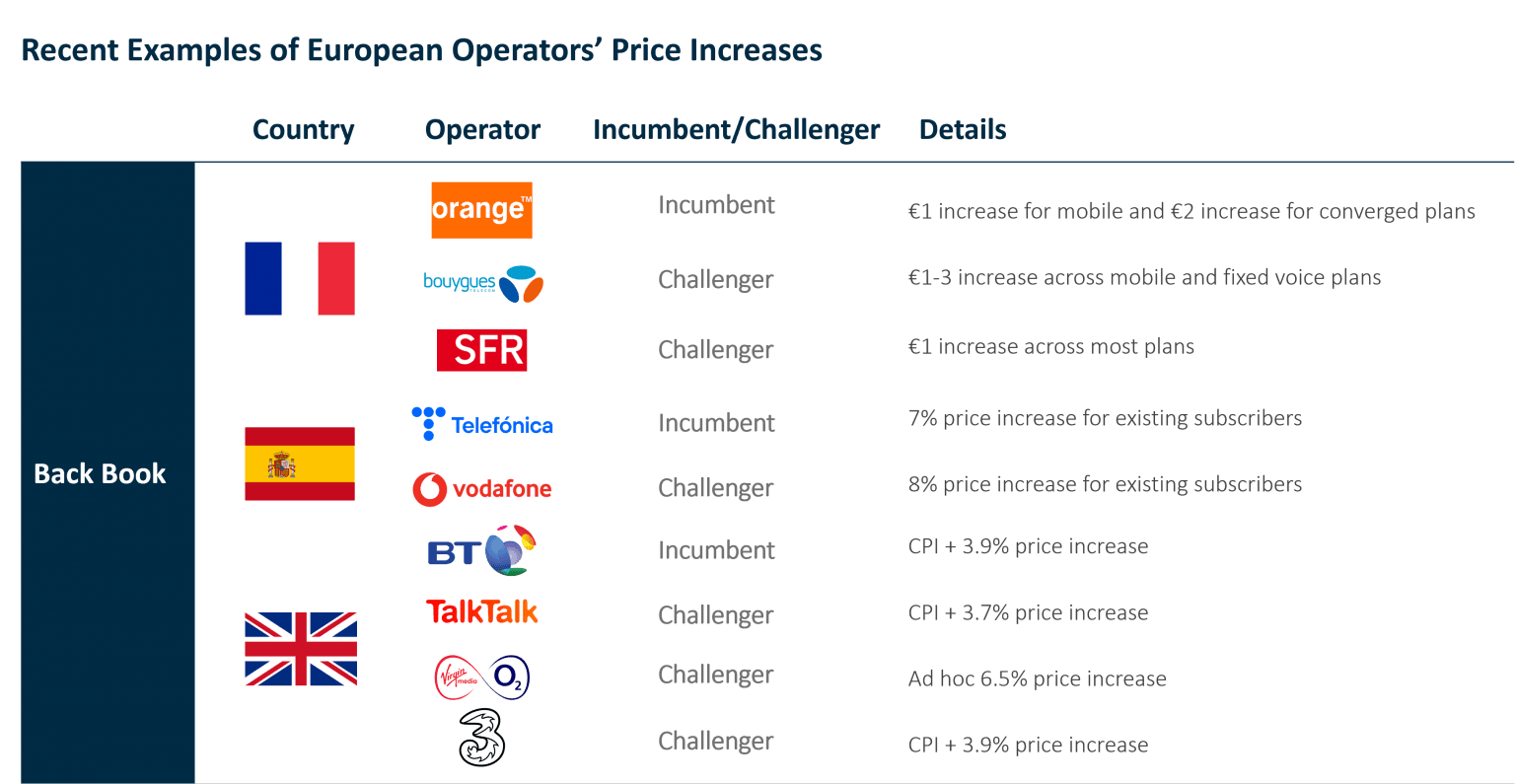

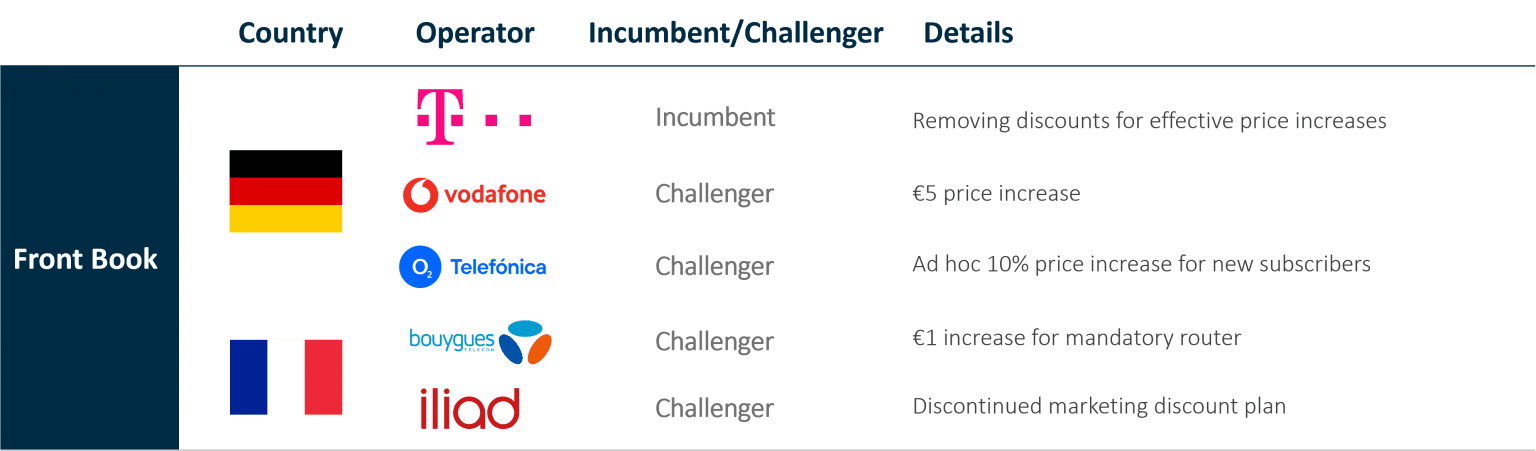

European operators have implemented a mix of these price increase strategies over the past 12 months.

The UK Market

Telcos in the United Kingdom generally pursued ad hoc or contractual price rises to keep up with the slow and steady inflation. However, Ofcom introduced new regulations in 2019 to limit mid-contract price rises and eliminate switching penalties. The operators in the market, led by BT, reacted by introducing CPI-plus pricing in new contracts starting in 2020. With such yearly increases clearly stated in the contract terms, the operator can bypass Ofcom’s new rule and impose early termination fees on customers canceling their contracts. BT enacted its first inflation-linked price rise in March 2020 and did not see any meaningful increase in quarterly churn since implementing the policy.

By 2021, BT subsidiary EE, as well as Plusnet, Vodafone, VMO2, and TalkTalk, had announced CPI-plus pricing schemes (with only Sky sticking to ad hoc price increases). Broadly, these near market-wide pricing movements without meaningful churn have provided credible evidence of telco pricing power in the United Kingdom. With these adjusted pricing strategies along with cost-cutting and hedging measures, telcos have managed revenues despite the macro conditions. By October 2022, global macroeconomic instability pushed the UK’s inflation rate up to a 40-year high, peaking at a CPI of 11.1%. While some telcos had already enacted yearly CPI-plus price rises, the record inflation prompted several telcos to change their price increase model to stabilize revenues.

In January 2023, the UK’s CPI hit just over 10.1%, putting additional pressure on pricing strategies. Ofcom has since announced a review of telcos’ CPI-linked pricing schemes, suggesting that the volatility of the CPI means that customers are not provided with enough clarity on future price increases. While this might impact UK telcos’ future pricing power, it remains to be seen whether cooling inflation and a return to the slow and stable inflation of the pre-Covid era will allow current pricing arrangements to remain.

An Essential Service

While the IMF expects global inflation to progressively cool through 2023 and 2024, many developed countries continue to see above-target inflation, which will continue to add pressure on telcos’ costs and margins and pave the way for further price rises. Despite price increase strategies implemented in several countries, telcos managed to avoid higher churn levels and negative impact on revenues across their fixed and mobile base. This can be explained by the fact that connectivity has become an essential service for consumers, which was particularly evident during the COVID-19 pandemic. A survey of U.S. consumers conducted by Horizon Media in March 2023 revealed that they are more likely to cut back on entertainment, lifestyle, charity, pet care, and transportation spending rather than switch to a cheaper mobile plan. This potentially strengthens telcos’ pricing power, but regulatory intervention remains key to ensuring fair pricing and a competitive proposition in fixed and mobile markets.